Overview

GAP & RTI Insurance – John Banks Group

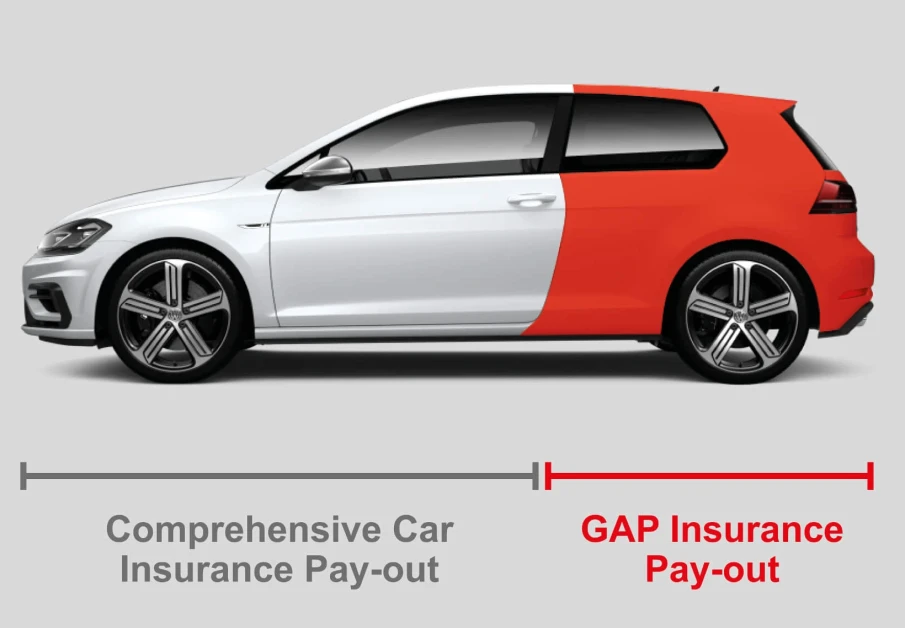

When you drive a new vehicle off the forecourt, depreciation starts instantly. Insurance typically only pays the market value at the time of loss — which often leaves a “shortfall” compared to what you originally paid or owe on finance.

Our GAP & RTI Insurance, provided in partnership with Premia Solutions, is designed to protect you from that shortfall, plus other costs stuck to your vehicle when it’s written off or stolen.

What’s Covered?

Finance GAP Insurance

Covers the difference between what your insurer pays and what you still owe on your finance agreement.

May also include cover for the initial rentals and help toward your motor insurance excess.

Return to Invoice (RTI) Insurance

Pays the difference between what your insurer pays and the original invoice value of the vehicle (including dealer or manufacturer options).

Also contributes toward your motor insurance excess.

Vehicle Replacement Insurance (VRI)

Bridges the gap between your insurer’s payout and the cost of buying a new equivalent vehicle, accounting for inflation, model changes, etc.

Also helps with your motor insurance excess.

Pricing & Cover Durations

Vehicles priced between £5,000 – £25,000:

• 36-month cover priced at £265

• 48-month cover priced at £345

Higher vehicle price bands attract higher cover premiums (up to £25,000+).

All covers include guaranteed contributions toward the motor insurance excess (up to £500) in the event of a total loss or non-total loss.

Some versions provide a courtesy vehicle in the event of a total loss (if the insurer deems the fault lies with the other driver).

Many policies offer up to £1,500 contribution toward dealer-fitted accessories.

GAP & RTI Insurance – John Banks Group

When you drive a new vehicle off the forecourt, depreciation starts instantly. Insurance typically only pays the market value at the time of loss — which often leaves a “shortfall” compared to what you originally paid or owe on finance.

Our GAP & RTI Insurance, provided in partnership with Premia Solutions, is designed to protect you from that shortfall, plus other costs stuck to your vehicle when it’s written off or stolen.

What’s Covered?

Finance GAP Insurance

Covers the difference between what your insurer pays and what you still owe on your finance agreement.

May also include cover for the initial rentals and help toward your motor insurance excess.

Return to Invoice (RTI) Insurance

Pays the difference between what your insurer pays and the original invoice value of the vehicle (including dealer or manufacturer options).

Also contributes toward your motor insurance excess.

Vehicle Replacement Insurance (VRI)

Bridges the gap between your insurer’s payout and the cost of buying a new equivalent vehicle, accounting for inflation, model changes, etc.

Also helps with your motor insurance excess.

Pricing & Cover Durations

Vehicles priced between £5,000 – £25,000:

• 36-month cover priced at £265

• 48-month cover priced at £345

Higher vehicle price bands attract higher cover premiums (up to £25,000+).

All covers include guaranteed contributions toward the motor insurance excess (up to £500) in the event of a total loss or non-total loss.

Some versions provide a courtesy vehicle in the event of a total loss (if the insurer deems the fault lies with the other driver).

Many policies offer up to £1,500 contribution toward dealer-fitted accessories.

Premia Solutions GAP or RTI Insurance from John Banks Group

GAP Insurance - Protecting your brand new investment

- 2026

From

£265